ifanr 访谈:创新工场易可睿——为中国创业者解码创业投资

ifanr 最近就各种投资、孵化模式的差异以及中国创业市场的情况跟他进行了交流。

第一部分:中国的创业投资行业/市场现状如何?

ifanr:中国的创业投资市场现在是什么状态?

Chris:

中国已经成为仅次于美国的世界第二大创业投资市场,虽然份额只有美国的 1/4、硅谷的 1/2,但对于一个仅仅发展了 5-10 年的市场来说,这已经是一个很大的成就,也表明中国在世界资本市场的重要性和影响力正日益凸显。

在过去的几年,一些美国顶尖 VC 都在中国组建团队,并专注于使用美元主导的基金投资中国的企业。中国政府也授权很多省市级政府在新设立的人民币主导的基金、担任有限合伙人,并予以资金方面的支持。这两个因素的结合带来了过去几年中国创业投资市场的高速发展。

ifanr:从你的角度看,美国创业投资的成功尤其是硅谷的成功,有哪些原因呢?

Chris:

培育像硅谷那样有活力的早期创业生态需要几个重要条件。

“创业家”的文化氛围和历炼程度,这包括他们对待风险的态度和对待失败的反应。在美国,创业者真正理解并接受创业的风险和失败的可能。如果其中一次尝试并没按照预想中的进行,甚至失败,创业者会从中吸取经验再开始新的尝试。这之间的间隔周期是很短的,而且失败往往被认为是有意义的经历。

所谓的“再循环”机制。大部分的资金、人才、专业知识会不断的流动,使得整个机制不断完善和强大。当成功的创业者退出之前的项目后,他们会继续创业或者担任其他创业企业的导师,或者两者兼有。硅谷在几十年前就做到了这一点,但中国才刚刚出现类似的现象,而且还仍处在最早阶段。

还有听起来很奇怪的一点——语言。硅谷成功的重要原因之一是它汇集了来自世界各地的最优秀的人才,英语的通用性使这一点成为可能。反观中国,语言则是吸引国外的优秀人才进入的一个障碍。

ifanr:中国的创业投资市场呈现了怎样的特征,未来会如何发展?

Chris:

我预计中国的创业投资市场会在未来几年持续保持高速增长,并且很可能在 3-5 年内达到美国市场一半的份额。将会出现越来越多的人民币基金,随着专业创业投资人才的引进和本地人才的成长,会有更多新的本地管理团队诞生。

在现阶段,真正的早期投资还没有引起足够的重视,因为中国目前创业投资行业的关注点仍在成长期和 IPO 之前的投资。但在未来的 3-5 年,早期阶段的投资会引起更多的重视,特别是创新工场目前活跃的消费互联网、移动互联网、云计算等领域。

第二部分:创业孵化器、天使投资和风险投资的特征和差异

ifanr:创业孵化器、天使投资和风险投资分别具有什么特征?

Chris:

孵化器

孵化器是为创业企业提供有形或无形的孵化服务和种子基金的公司。孵化服务一般包括法务、财务、人力和 IT 等方面,种子基金的数额在 1 万美元到 10 万美元之间。一些孵化器会有限定时间的孵化项目(比如 Ycombinator,TechStars,创新工场助跑计划),一些孵化器会向创业企业提供出租场地(比如 PlugAndPlay)。孵化器会通常会提供各种指导,而想接触孵化项目的天使投资人和早期 VC 也会经常地拜访孵化器。在选择孵化器时最重要的标准就是看其可以提供的帮助和资源,而这取决于孵化器的管理团队和员工。

天使投资人

天使投资人是富裕的个人,使用自有资金进行投资,每个人的每笔投资额一般在 1万到 100 万美元之间。相比 VC,天使投资人的投资决策更加灵活和迅速,投资条款也更为宽松。一个天使投资人不一定是专业的投资者,作为创业企业的首个外部投资人,他们往往把投资作为“爱好”或是出于帮助创业者的目的,不仅仅是为了获得投资回报。天使投资人一般投资本地的创业企业,互相信任的天使投资人之间往往联合一起投资。天使投资人非常关心所投资公司,并且和团队的创始人以及其它成员建立良好的个人关系。他们会向所投资公司提供建议和个人关系网络,以及合适的行业知识。

风险投资

风险投资(VC)是使用别人的资金进行专业投资的机构。大多数的企业不会使用风险投资资金,对企业解决资金问题来说,风险投资只是众多选项之一。但是很多成功的科技创业企业最终都使用了风险投资的资金。每一笔风险投资的投资额一般在 50万到 2000 万美元之间。风险投资(VC)的投资决策会更为谨慎,投资条款也更为严格。

典型的早期阶段的风险投资(VC),投资条款一般包括以下内容:10 年期有限合伙资格;有限合伙人提供资本,并要求 30% 的内部收益率;管理合伙人进行投资,履行找项目、尽职调查、交易构建和投资后管理的职责;管理合伙人和有限合伙人以 1:4 的比例分享附带收益;通常情况下,有限合伙人会向管理合伙人支付每年 2% 的管理费。

ifanr:创新工场属于何种情形?

Chris:

创新工场是一种混合模式。一方面,创新工场是一个“手把手”的孵化器,为创业者提供场地,并为不同类型的创业者提供助跑计划、加速计划、创业家计划等不同的孵化项目。另一方面,创新工场也会选择性地为它孵化的项目提供早期阶段的资金,尤其是天使和 A 轮融资。

因此,创新工场由两部分组成:一是孵化器,在一定时期内持续投资新项目,并为新项目提供服务。二是创新工场开发投资基金(IWDF)会选择性地投资那些从创新工场“毕业”的项目。可以说创新工场扮演着天使投资人和早期VC的双重角色。

第三部分:给中国创业者的指导和建议

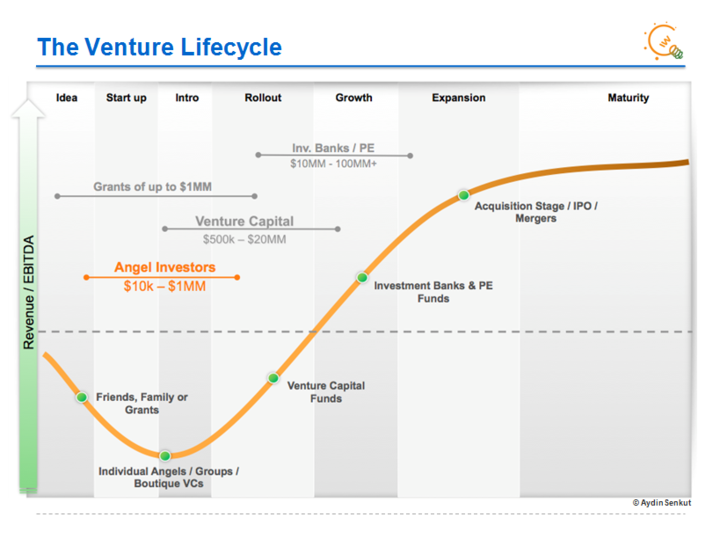

ifanr:前面介绍的孵化器、天使投资、风险投资,以及投资银行、最后的上市 IPO,都会在一个创业企业的哪些过程阶段出现呢?

Chris:

你可以从下面的图片中看到风险投资的生命周期。

ifanr:你觉得在开始创业时,创业者应该做好哪些准备呢?

Chris:

创业者应该对创业早期阶段的生态环境有清晰地了解:

- 市场:这应该是一个足够大的并有很多发展机会的市场。

- 企业家精神:资质优秀、驱动力、技能和想法……这些都是应该具备的精神。

- 孵化器:为创业公司提供真正“量身定制”的服务。

- 早期投资者:有一个天使投资人的群体和早期 VC。

- 创新:具备“创新”的文化。

ifanr:创业者如何选择风险投资机构呢?

Chris:

创业者选择投资者就像投资者选择他们的投资对象一样,甚至比选择投资对象更重要。

“Smart Money”: “附加值”才是最重要的选择标准。创业者不仅仅要关注投资本身,更要关注投资者是否可以提供资金之外的帮助。要关注普通合伙人的背景和行业知识,以及是否可以和投资者已经投资的企业产生协同效应,也可以参考那些同领域的其他企业成功的案例。尽职调查虽然是一个复杂的过程,但会很有帮助。

ifanr:最后,请给中国创业者的提出一些建议?

Chris:

从很多方面都可以证明,未来是属于中国的。中国的创业者,尤其在创新工场目前正在投资的技术领域,在未来几年内会拥有很好的机会。当然,创业者肯定会面临很多困难和激烈的竞争,但是一定要有勇气,并且全速前进。抓紧时机,发掘好的创意,提升产品的实现能力。

创业者要把握住中国大陆市场的高速发展机遇。从时代和机遇来说,这确实是在中国创业的最好时机,一定不要错过。

附英文原文,见第二页。

ifanr: How about the current Chinese VC market condition at the moment?

Chris:

The Chinese VC market is already the 2nd largest VC market in the world but, to put things into perspective, it is still only about ¼ of the U.S. equivalent (or ½ of Silicon Valley, if you prefer). This is already a major achievement for China, as it has happened only in the past 5-10 years, and it portrays fairly accurately the Chinese market’s importance and influential role in the global venture market.

It is of no surprise therefore that several of the top-tier VC firms in the U.S. have, in the past few years, built teams in China and raised China-specific USD denominated funds. Or, that the Chinese government has empowered and financed a lot of the provincial or city-level governments to act as Limited Partners (LPs) for newly-setup RMB denominated funds. The combination of these 2 factors has fuelled even further growth in

the past couple of years in the China VC industry.

ifanr: What kind of factors makes the U.S. VC market success, especially in Silicon Valley from your viewpoint?

Chris:

There are several factors that are important in creating a vibrant early stage ecosystem, such as Silicon Valley in the U.S., but the most critical in my opinion are the following:

The sophistication and culture of the entrepreneurs, including their appetite for risk and reaction to failure. In the U.S., entrepreneurs truly understand and accept start-up risks and potential failure. If a venture is not progressing as planned, or it fails, the entrepreneurs are likely to learn from it and move on to a new venture. Iteration cycles are short and failure is usually considered to be a constructive experience.

What I call the “recirculation” effect, that is the fact that in such ecosystems most (if not all) of the capital, talent, know-how, etc. that is created from the various ventures goes back into the ‘system’ thus creating an ever-growing and ever-powerful pool. For example, successful entrepreneurs when they exit they can become serial entrepreneurs, or they become angel investors and invest the money they have made, or they become VCs, or the become advisors and mentors to other start-ups, or combination of some of the above. This in the Silicon Valley has been happening for some decades already, but in China this is a new phenomenon that only just started. We are still at the 1st such generation.

Language. As strange as it may sound, one of the key success factors of the Silicon Valley is the fact that it has managed to accumulate some of the best, brightest and most talented people from all over the world to go work and create there. This was made possible by the English language facilitating all communications.

If you think of the Chinese early stage ecosystem by comparison, language is still a barrier that will dissuade a lot of top talent from coming here.

ifanr: How about the future of Chinese VC market and what kind of feature it has presented right now?

Chris:

I expect the Chinese VC market to continue growing rapidly in the coming years and potentially reach 50% of the U.S. market within the next 3-5 years. There will be increasingly more and more RMB funds and several new, much more local management teams, as venture management expertise will be transferred to and also gradually developed by local managers.

At the moment there is very little attention to truly early stage investments, as the focus of the VC industry in China has so far been in the growth and pre-IPO stage of investments but in the next 3-5 years I expect more and more attention to early stage, especially in the fields that Innovation Works is currently active, i.e. consumer internet, mobile internet, cloud computing, etc.

ifanr: How to distinguish from Incubators, Angel Investors and Venture Capital?

Chris:

Incubators

l Companies that offer physical or virtual incubation services and some seed financing to start-up companies.

l Incubation services usually include legal, accounting, HR and IT support.

l Seed financing range between $10K – $100K per start-up project.

l Some incubators have time-delimited programs (e.g. Ycombinator, TechStars, IW’s Jump-Start) and others have their space open for rental (e.g. PlugAndPlay) by the start-ups.

l Incubators usually offer access to education and mentoring resources and are frequently visited by angel investors and early stage VCs who want to have access to the projects being incubated as part of their dealflow.

l The most important criterion in the selection of an incubator is the help and resources that it can provide, and this depends on the management team and staff of the incubator.

Angel Investors

l Wealthy individuals, which invest their OWN MONEY.

l Investments range between $10K – $1M per person, per deal.

l Investment decision is typically quick and flexible. Investment terms are “lighter” than VC.

l An angel may be, but not necessarily is an “accredited” or truly knowledgeable investor.

l Invest with the expectation of a financial return but also as a “hobby” and usually with a willingness to help.

l Commonly the first external investor(s) in a start-up.

l Invest usually locally and prefer to syndicate in small groups with fellow angels they mutually trust.

l Usually care about the entrepreneurs and the companies they invest in and interested in building personal relationships with the Founders and other team members.

l Offer advice and guidance to Founders, their own personal networks and, when applicable, core domain expertise.

Venture Capital

l Professional investment managers that invest OTHER PEOPLE’S MONEY.

l Most businesses do not use VC money. VC is only one of many financing options for a company.

l But, most successful technology startups eventually have taken VC money.

l Investments range between $500K – $20M per deal.

l Major differences between early stage vs. growth stage VC.

l Investment decision is typically slower and more bureaucratic, but also usually more diligent. Investment terms can be very strict.

l Typical early stage VC “fund”:

l 10 year limited partnership.

l Limited Partners (LPs) provide capital. They expect a minimum of 30% net IRR.

l Investment professionals (?) – the General Partners (GPs) do the investing. This includes deal sourcing, due diligence, deal structuring and post-investment portfolio management.

l Both GPs and LPs share in the carried interest (profit after return of investment capital to LPs), usually 20% for GPs and 80% for LPs.

l Usually LPs pay the GPs an annual management fee of 2%.

ifanr: So which one does the Innovation Works belongs to?

Chris:

Innovation Works (IW) is a hybrid model that combines (a) a “hands-on” incubator with its own physical space and various incubation programs (e.g. Jump-Start, Acceleration and EIR) catered to different types of entrepreneurs, with (b) a captive, truly early stage fund that invests selectively in the companies that it incubates, predominantly in their angel and Series A rounds. Therefore, IW has two main parts, its incubator that continuously creates and/or supports new projects for a certain period of time, and its IW Development Fund (IWDF) which can only invest in some of the projects that “graduate” from the incubator. IWDF acts both as an angel investor as well as an early stage VC.

ifanr: When those kind of VC that you have talked above start to work as the enterprises grow up?

Chris:

The Venture Lifecycle as bellow.

ifanr: what should the entrepreneurs be ready when they start up?

Chris:

An early stage Ecosystem

l Market … A big enough market with major growth opportunities.

l Entrepreneurship … Talent, drive, skills and ideas – all widely available.

l Incubation … Real ‘turnkey’ services for start-ups.

l Early Stage Investors… A community of angel investors and early stage VCs.

l Innovation … A culture of innovation.

ifanr: How the Entrepreneurs to select their investors?

Chris:

Entrepreneurs select their investors just as much (if not even more) as investors select their deals.

“Smart Money”: value add should be by far the most important selection criterion – how can this investor help you over and above money?

The background of the GP(s) championing your deal – domain expertise.

Potential synergies with any other existing portfolio investments.

Track record of successfully exiting portfolio companies in your sector, in various different ways.

Due diligence process is a “pain” but it is also a beneficial process – think positive!

ifanr: At last, would you like to give some advices to the Chinese entrepreneurs?

Chris:

The future belongs to China, in many different ways. Chinese entrepreneurs, especially in the technology space that IW is active in, have a unique opportunity today and in the coming years to capture the unprecedented growth that the domestic mainland China market will experience.

There will certainly be considerable difficulties, fierce competition and entrepreneurs will need to be fearless and move with determination and great speed. But from a timing point-of-view, this is probably the best moment to start-up in China. Just go for it.